Key Market Insights

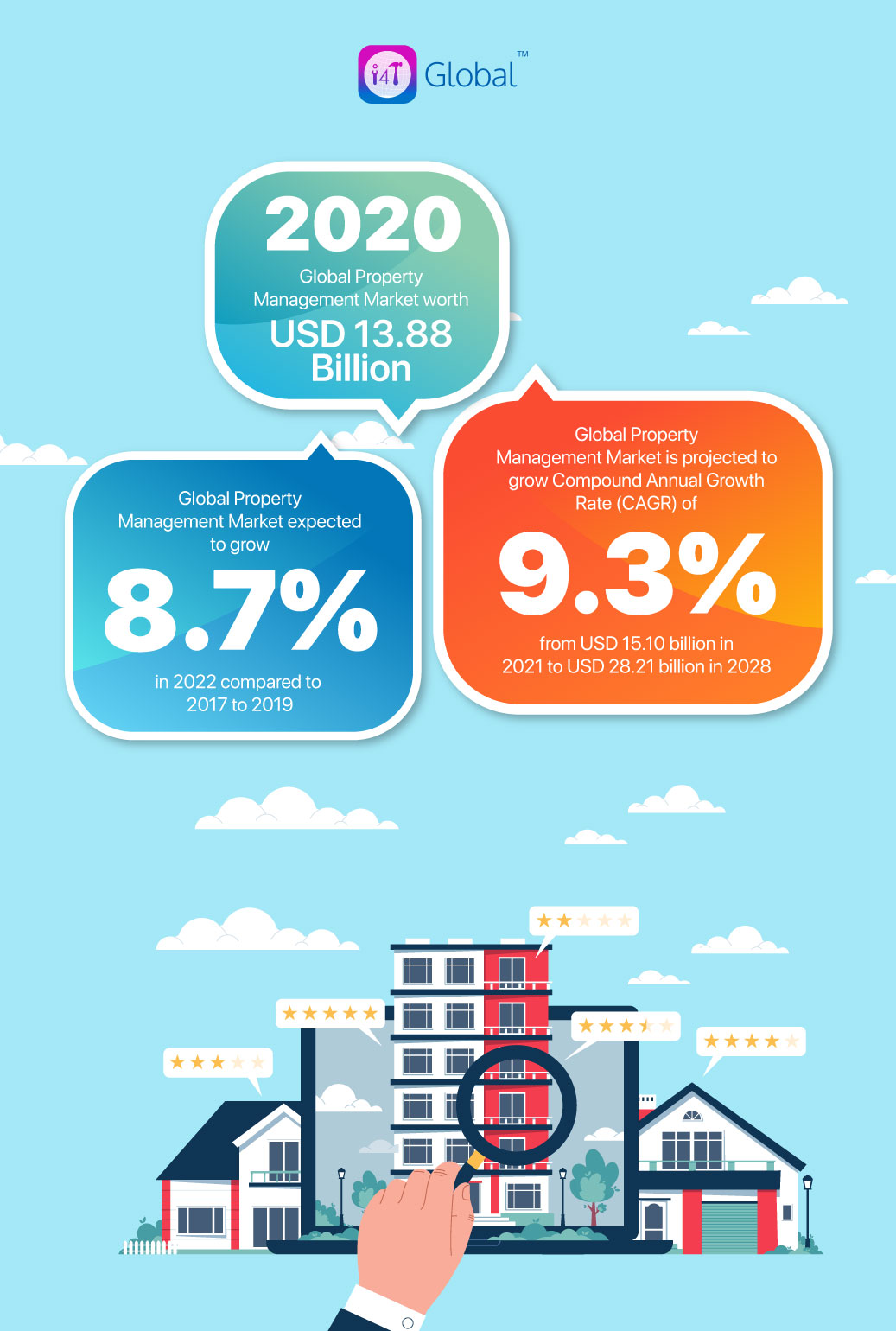

The Global Property Management Market was worth USD 17.69 Billion in 2021 and grew to USD 18.2 Billion in 2022 . COVID-19 has had an unprecedented and staggering global impact, with Property Management Software/Services experiencing a positive demand shock across all regions as a result of the pandemic.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) 9.8% from USD 19.33 billion in 2022 to USD 37.25 billion by 2029, according to Fortune Business Insights, in a report titled: Property Management Market, 2022 – 2026. The consistent rise in CAGR due to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

The increasing demand for tools and platforms to address customers’ changing real estate preferences, as well as the growing need for better consumer handling and support, are driving the market growth.

Property Managers and Real Estate Agents are focusing on leveraging the benefits of Property Management Software to grow their customer base by utilising a unified technology platform.

The Real Estate Industry is undergoing a rapid transition, characterised by the evolving role of hotel and lodging brands and the emerging use of a platform approach to customer retention.

As part of their business strategy, key players are heavily investing in research and development activities, which has elevated property management solutions even further.

Impact of COVID-19

Short-term concerns for Property Managers include maintaining value and liquidity, keeping visitors and tenants safe, including increased cleaning measures, and adhering to governmental standards.

Despite the fact that many schools and offices are closing and businesses are considering “work-from-home” options, the contagious nature of the virus means that the risk of infection is always present, both indoors and out. People are also flocking to public places such as offices, supermarkets, and hospitals in large numbers.

Now that COVID-19 has been formally classified as a pandemic by the World Health Organisation, it is even more critical for Property Owners, Operators, and Management Teams to be agile and organised in order to continue reducing infection risks within buildings and limiting potential transmission events.

The COVID-19 pandemic has given Property Managers a chance to pause, reflect, and use their time in lockdown to consider implementing new processes that will make life easier once things return to normal

Driving Factors

Increasing Demand For SaaS-Based Software/Solutions To Facilitate Property Management Market Growth

Cloud Computing and SaaS (Software-as-a-Service) integrated services have grown in popularity as a preferred method of service delivery.

Subscription-based SaaS solutions will benefit businesses of all sizes. Firms in the market are increasingly turning to SaaS solutions to streamline processes by automating workflows and eliminating manual input.

By implementing SaaS solutions, businesses can reduce the difficulty and cost of on-premises implementation.

SaaS software makes it simple for large multifamily property management companies to integrate various types of software across their portfolio.

Furthermore, the SaaS model is critical for multi-vendor device compatibility with legacy systems.

Regional Insights

Geographically, the market is segmented across five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

In 2022, North America captured the largest share of the property management market.

The expansion of e-commerce in North America is expected to create numerous opportunities for real estate players and property managers to invest in property management software/services.

External investment in the region’s real estate sector is expected to increase significantly in the coming years.

2023 Property Management Industry Trends

Implementing Integratable PropTech Is Do-or-Die

With the pandemic pushing all industries to move into a more virtual, tech-enabled space, the Property Management Industry has been forced to both create and implement PropTech (Property Technology) that automates many manual processes and allows for a more remote lifestyle.

Remote work and remote processes are becoming more common, and the normalisation of even more of the instant gratification that technology inherently provides is visible.

Management companies that lack a solid technological infrastructure that enables higher service levels which are now both expected and demanded by prospective residents and owners will fall behind the curve.

On the other side, management firms that use too many software and platforms without integrating them to allow them to communicate with one another and merge data are creating an organisational mess of data that is siloed away from one another.

When your data is scattered across multiple platforms, it’s nearly impossible to keep it up to date and aligned across platforms, let alone properly understand/analyse and make strategic decisions.

The more easily integrated your systems are, the better the company’s long-term business health.

Labour Shortages In the Vendor Space Will Require Creative Solutions.

One of the most significant challenges in 2022 has been a labour shortage of available vendors to handle maintenance work orders.

Residents spending more time at home increased the volume of maintenance requests, while the pool of labour available remained the same or shrank in many areas.

This has resulted in an even longer delay in work order completion time, as well as a larger hit to maintenance spending because contractors are raising their rates to prioritise jobs. With fewer younger generations entering the trades, this trend will necessitate some creative solutions in 2023, centred on optimising time and establishing a stronger network of providers.

Service-Oriented Amenities For Residents Will Be More In-Demand

Essentially, residents now value higher service levels and faster communication over physical amenities. For many, this means much faster response times to maintenance calls and more services available to connect to instantly.

Service-oriented amenities have been more widely adopted in the multifamily space, and are now making their way into the single-family space to settle in and re-define what it means to rent a home.

A Traditionally Fragmented Single-Family Market Will Continue Consolidating

Because of the breadth of opportunity, which has been accelerated by the pandemic, a lot of institutional and venture capital money has been poured into the single-family market over the last few years. Because residents have adopted a more remote culture, there is less demand for living in a city close to work and more demand for living in a larger single-family home where the home is the office and rent is less expensive.

These large corporations see the potential for a massive return on their investments in the single-family space in the long run, so they are beginning to acquire smaller single-family management companies, further consolidating the space.

Because they are typically companies with the technology, systems, and processes to operate at an economy of scale, and thus higher margins, it is more cost-effective for them to acquire single-family management companies that are already established, rather than chasing after single landlords as clients.

Build-to-Rent Concepts Will Be Adopted At Higher Rates

Companies with a lot of capital to invest are developing entire teams and portfolio segments in “Build-to-Rent” communities, which is in line with the previous trend. The Build-to-Rent concept entails the construction of single-family homes in neighbourhoods with the intention of renting them out professionally rather than selling them.

It’s well known that millennials are slower to reach the home-buying stage due to a variety of factors including being unable to afford to buy a home or preferring to rent for the amenities and to fit a more non-committal lifestyle. So, capitalising on this trend, there is an increasing development of Build-to-Rent communities with a higher home price and mortgage rates, which will become more common in 2023. These kinds of residential properties are gaining more market share.

The future of the Rental Property Market has arrived.

Tweet styling for Maintenance article. Tweet styling for Maintenance article. Tweet styling for Maintenance article.

Real-time communication will continue to be important, but proximity to work is no longer as important as it once was.

Also, refer to The Value In Time Within Property Management & How PropTech Can Make Lives Easier

Property Managers who adapt to these changes will thrive as the market enters this new era. In 2023 and beyond, innovation will be critical in the evolving rental property landscape.

i4T Maintenance

i4T Global is an easy-to-use Property Management Software, designed to save you time & money. It allows you to easily:

- Collect payments

- Store tenant details

- List properties

- Manage work orders

- Obtain quotes

- Communicate with tenants, & suppliers and much more.

To stay updated with Property Management Trends, Market Insights & Other Property Management Resources, follow us on LinkedIn, Facebook, & Twitter.

You might also be interested in:

- New Year New Approach” In Relation To Digital Transformation And PropTech

- 22 New Year Resolutions For Property Managers in 2023

- Recap of Field Service Management Market in 2021 and the Trends That Will Shape the FSM Sector in 2023

Hot off the press!

With our cutting-edge technology and in-depth knowledge of how the Field Service Management sector operates, the i4TGlobal Team loves to share industry insights to help streamline your business processes and generate new leads. We are driven by innovation and are passionate about delivering solutions that are transparent, compliant, efficient and safe for all stakeholders and across all touch points.