“We don’t ever have enough cash flow to pay or manage taxes’’

As a Business Coach in the industry, I have heard many of my clients say that they never have enough cash flow to pay taxes. This can be a bit concerning.

Tax planning and management are important to establish business legitimacy, whether the business is small or big, every business must ensure to keep the tax man happy.

There are several reasons why businesses fail to do so. Some of which may include:

- The Lack of Funds

- Incomplete Documentation

- Confused with the process of paying Taxes

- Laziness

For new business owners or growing businesses, one of the most common stresses is cash flow, and one of the hardest things to manage is the Tax bill.

If you are new to the business you forget that you collect taxes for the tax man, in Australia your business is registered for Goods and Services Tax (GST).

GST is not your money, but the money you collect from your consumers by selling goods or services. The collected money is then passed on to the taxman at some point.

In this world, Nothing is certain except for death and taxes

Just imagine never having to stress about Cashflow or a Tax Bill!

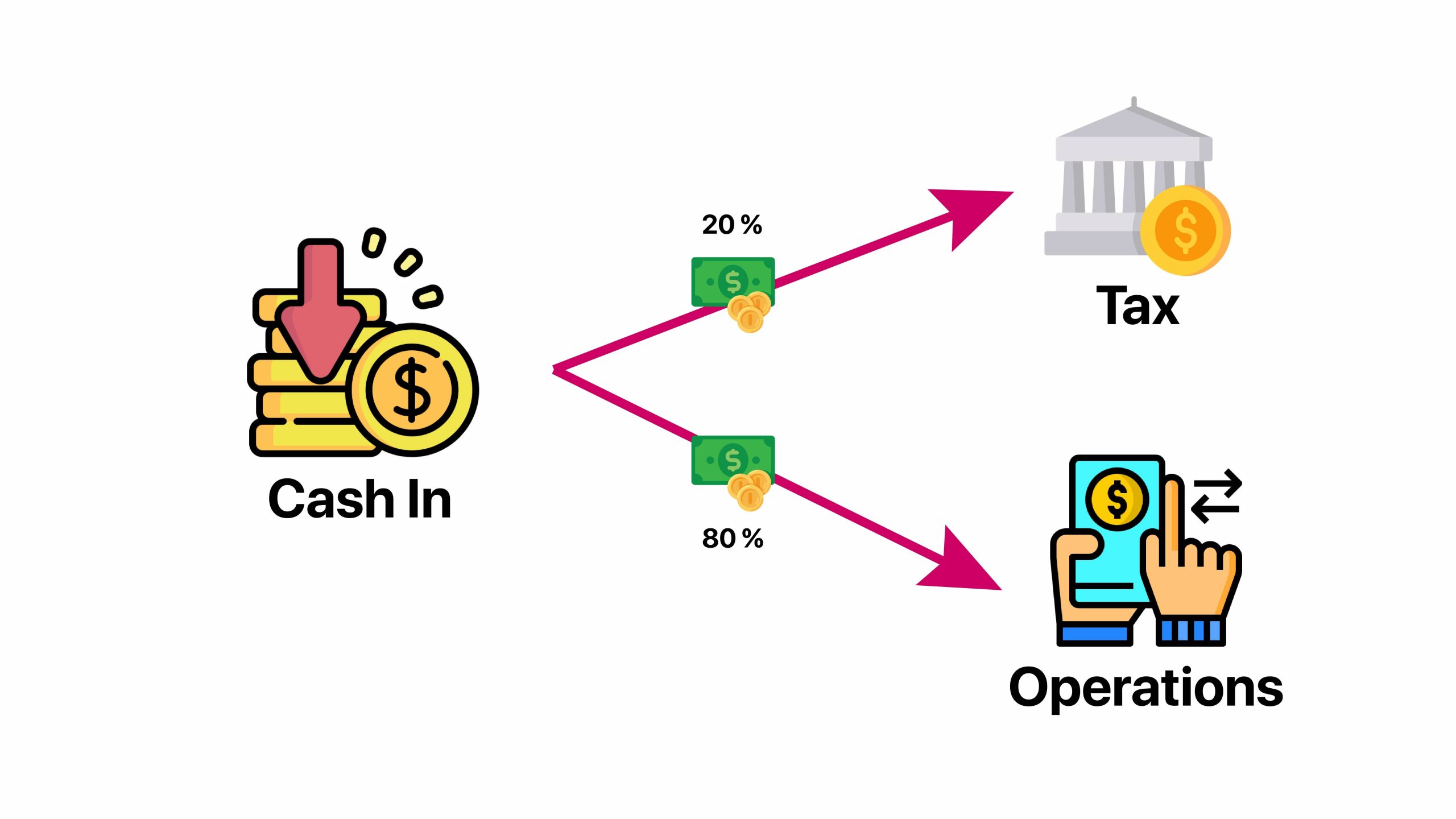

There is a percentage of the money you get paid that must be paid to the Tax Department. It will vary based on the size of your business, how many people you employ and the profit you make.

A simple way to go is to ask your accountant for the percentage of tax that you will have to pay when you get paid. If you don’t know yet – then start with 20%.

So let me break down my one tip into 7 simple steps so that you can create a strategy to keep the taxman happy!

Step 1 : Re-name your Current Bank Account

Step 2: Create a Secondary Bank Account

Step 3: Create a Third Bank Account

Step 4: Identifying Direct Debits

Step 5: Keep Track of your Bank Account

Step 6: Pay your Business Costs and Expenses.

Step 7: Pay your Tax on Time

Wrapping up

Hot off the press!

By Alan Short | Founder and Lead Coach | Global Business Coaching

Business Coach for i4T Business